Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 17 comments

Cliff Auerswald 17 commentsBy  Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 17 comments

Cliff Auerswald 17 comments

The U.S. Department of Housing and Urban Development (HUD) mandates that homeowners exploring a Home Equity Conversion Mortgage (HECM) must receive essential counseling. This counseling, provided by a HUD-approved HECM agency, covers the details and alternatives of reverse mortgages.

To assist you, we are required to offer a list of approved reverse mortgage counseling agencies. This list includes five nationwide companies as specified by HUD for HECM, alongside local agencies near you. The number of nearby agencies varies; some borrowers may have several options, while others might need to travel further for in-person counseling.

Additionally, we include agencies offering phone-based counseling, making location less critical, as they are accessible through toll-free numbers. Your priority should be to select a counselor who aligns with your specific counseling needs, ensuring you make an informed decision about your reverse mortgage.

| Counseling Agency | Next Availability | HECM Price | JUMBO Price | Phone | Website | |

|---|---|---|---|---|---|

| QuickCert | 24-48 Hrs. | $145 | $145 | 888-383-8885 | Website |

| Hancock Community Development, Inc | 24-48 Hrs. | $130 | $140 | 877-284-4326 | Website |

| DebtHelper.com | 24-48 Hrs. | $145 | $145 | 800-920-2262 | Website |

| Credit.org | 24-48 Hrs. | $150 | $150 | 800-294-3896 | Website |

| Cambridge Credit Counseling | 24-48 Hrs. | $149 | $149 | 888-764-7460 | Website |

| Money Management International (MMI) | 48-72 Hrs. | $199 | $199 | 877-908-2227 | Website |

| National Foundation of Credit Counseling | 48-72 Hrs. | $199 | $199 | 866-698-6322 | Website |

| GreenPath Financial Wellness | 1 Week | $199 | $199 | 888-860-4167 | Website |

| Hope Inc. | 1 Week | $200 | N/A | 844-432-6467 | Website |

| Clearpoint Financial Solutions | 3 Weeks | $199 | $199 | 877-877-1995 | Website |

The estimated counseling availability times are approximations, with the latest update provided on May 28, 2024

Search our newest interactive map that locates HUD-approved agencies nearby with in-person availability.

Lenders and brokers are prohibited from collecting fees or financial details such as bank account or credit card information from borrowers before receiving a HECM Counseling Certificate. The counselor must sign and date this certificate and all individuals mandated to undergo counseling. No fees can be charged, and the loan application process cannot proceed without this completed and signed certificate.

Counseling on a reverse mortgage is an independent session conducted by a third party. It is a requirement for all reverse mortgage loans. The counseling aims to ensure that all borrowers and spouses understand the reverse mortgage and their obligations when they have one.

A reverse mortgage counseling certificate is valid for 180 days. For HECM loans in most states, the certificate must be current at case number assignment, but the loan can close if the certificate has expired . For example, in some states like Texas , the certificate must be unexpired at closing, or the borrower must complete another counseling session before the loan closes.

A reverse mortgage loan is a complex financial instrument; counseling is required to safeguard the consumer. FHA and reverse mortgage lenders must ensure that all reverse mortgage applicants understand what a reverse mortgage is and their requirements as a homeowner obtaining a reverse mortgage.

All borrowers on the loan, as well as any non-borrowing spouses, must be counseled. Additionally, any Remainderman of a Life Estate or other parties holding title to the property and not eligible borrowers must also be counseled for the reverse mortgage.

There is no personal liability for the reverse mortgage loan to the borrower or their heirs. The sole collateral for the reverse mortgage loan is the property. Suppose the property value is lower than the accrued balance on the loan. In that case, the heir can repay the loan in full at 95% of the current market value as determined by an appraisal at that time or can walk away and let the lender worry about the disposition of the property and owe nothing.

After you have completed your counseling, you will be mailed a certificate of completion ( view sample certificate ). This Counseling certificate should be signed and returned to your lender if you wish to proceed with processing the loan. 3rd party services, such as Appraisal, Title, or Escrow, may only be ordered once the lender has your signed certificate.

Counseling certificates come from agencies approved by HUD. They can be used with any lender which isn’t tied to a specific lender. This means you don’t have to transfer the certificate to a different lender if you decide to switch, unlike the HUD Case Number, which must be transferred to a new lender if you change your mortgage company.

Counselors or counseling agencies decide their fees, but HUD sets a cap. Occasionally, you can find free counseling if the agency has grant money to cover the costs for borrowers. Currently, the fees are around $125-150, but you’re encouraged to shop around and see if any counselors offer lower rates.

Many states have rules for reverse mortgage counseling in addition to HUD’s requirements. The specific counseling needed depends on location and when you last received counseling. You may need counseling again, but it’s always a good idea to check and ask.

Yes, all trust beneficiaries need to undergo counseling. When a property is part of a trust, the beneficiaries are viewed as the owners. For a HECM (Home Equity Conversion Mortgage) reverse mortgage on a trust-owned property, every beneficiary must be listed as a borrower. Moreover, they all need to attend the mandatory HECM counseling session.

Yes, a Power of Attorney (POA) can attend the counseling session for the homeowner. However, the POA must have been signed before the homeowner became incapacitated. The lender will also need to verify that the homeowner could grant the POA when it was signed, which involves getting notes from a doctor. This is a standard procedure required by HUD whenever a POA is used.

The time it takes to get your certificate after counseling can vary depending on the counselor. If the agency sends your certificate by mail, expect to wait a week or more. However, request your counselor to email the certificate directly to you or your lender. You can often receive it on the same day. If you or your lender have a good printer, you can print out an original copy to sign with ink, avoiding delays.

You can start or request an application without completing counseling first. However, lenders can only begin loan processing services once you’ve completed counseling. This means your loan process won’t progress until after counseling.

Reverse mortgage counseling companies are approved by HUD but run independently. If you’re interested in working for one, it’s best to reach out to them directly. You can find contact details for these companies through HUD’s counselor locator tool on their website. I recommend starting with agencies in your area. You can access the HUD counselor locator page at this link: https://apps.hud.gov/offices/hsg/sfh/hcc/hcs.cfm

Additional Documents for CA Homeowners:

ARLO recommends these helpful resources:

Michael G. Branson CEO, All Reverse Mortgage, Inc. and moderator of ARLO™ has 45 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively.

Look no further. Michael G. Branson, our CEO, brings a wealth of knowledge directly to you. With a robust 45-year tenure in mortgage banking and 19 years dedicated solely to reverse mortgages, he's the expert you want on your side.

Post your question in the comments below and anticipate a personalized response from Mr. Branson himself, typically within one business day. He's here to illuminate all angles of reverse mortgages, ensuring you're equipped with the knowledge to make informed decisions. Take this opportunity to gain insights from a seasoned professional.

17 Comments on this Article| Janis B. March 14th, 2022 |

I read every word here and am glad to see an opportunity to enter a comment now at the end. I found every answer given to the variety of questions to be clearly expressed and, even though I had the counseling years ago and have been in a HECM reverse mortgage ever since, I learned a few things here of which I was either unaware or misinformed. Excellent work, ARLO.

| Michael Branson March 15th, 2022 |

| Michael Branson June 29th, 2021 |

Most states have enacted their own counseling requirements for reverse mortgages now as well as the HUD requirements so you would really need to see what the requirement is for your area, and it may depend on when you were last counseled. I would guess that you will probably need to attend counseling again at this time, but it never hurts to ask.

| Marshall K. March 9th, 2020 |

| Michael Branson March 9th, 2020 |

You can find counselors that are approved by HUD and can offer the counseling in different languages by using the HUD website. Firstly, you click on this link:

A state map will come up and you can click on the map or on the state of your choice in the upper left hand corner.

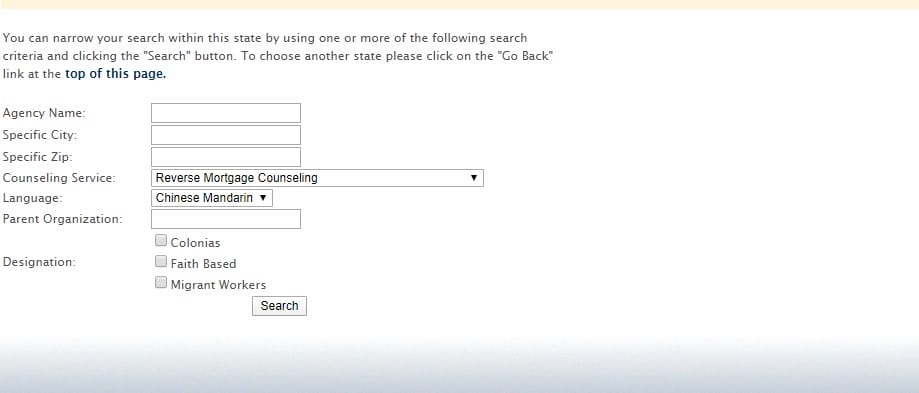

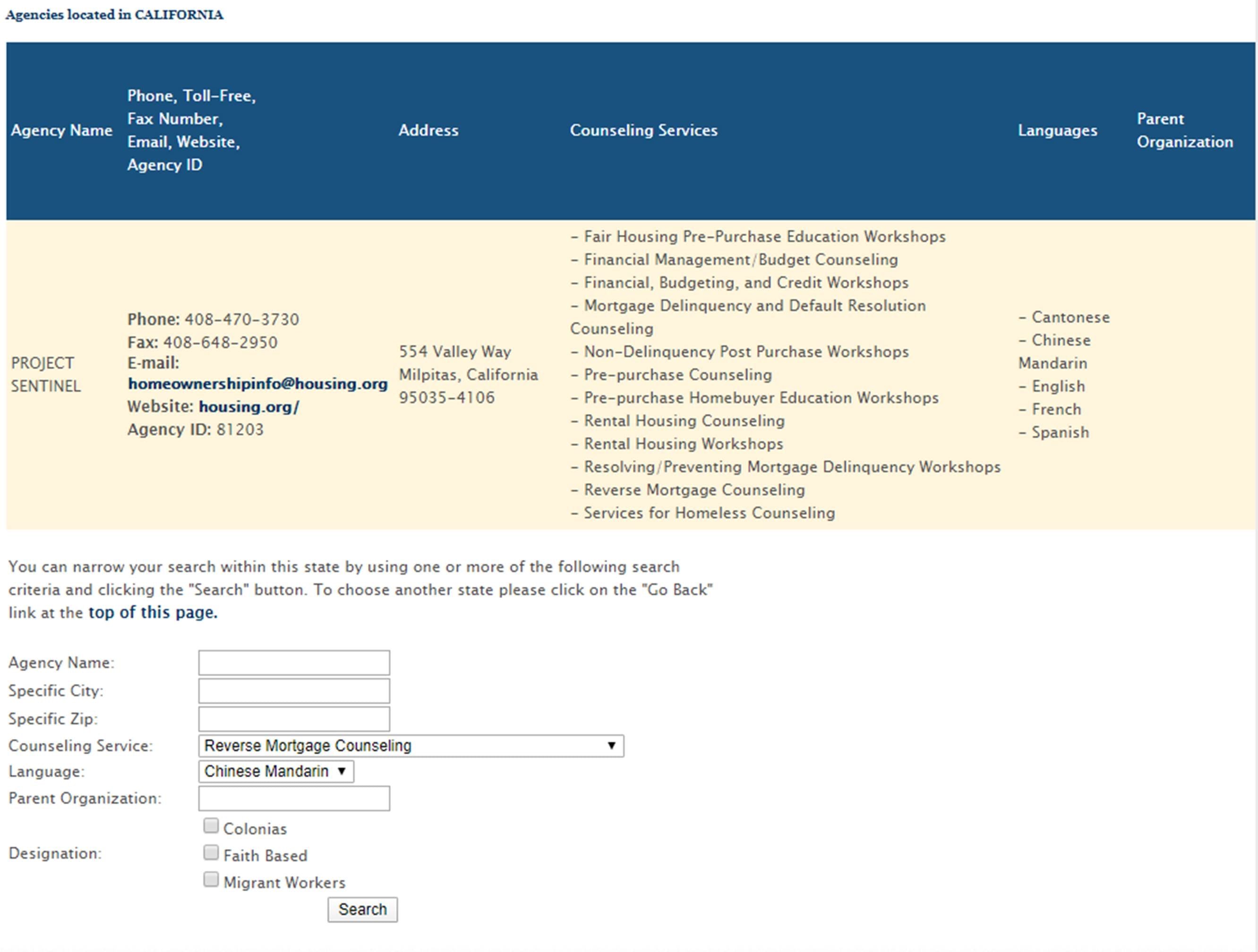

After you click on the state of your choice, next you will have to go to the bottom of the page and narrow your search. There are many choices you can use to narrow your search including specific cities, zip codes and others (shown below) but since not all services and languages are offered in all states, we suggest you narrow down just to the state level and your specific need. In this case, I used Reverse Mortgage Counseling and Chinese Mandarin as my search parameters in the state of CA and the search narrowed down to just one agency in the entire state.

If your request is not shown, you may have to check other states as well. Remember though, you can complete the counseling on the phone in almost all cases so it is not imperative that the counselor be located nearby. Remember that in some cases, a counselor in just over the state line another state may be closer than one located in the same state but at the other end of the state.

| Boehler V. March 3rd, 2020 |

My father has a reverse mortgage and wants to refinance. He lives in Washington and wants to see the waiver in order to not do the counseling again. He did the counseling in 2018.

| Michael Branson March 3rd, 2020 |

Most companies will require your father to counsel again at this time. HUD does not always require counseling if the borrower has attended in the last 5 years, but many of the states do. HUD does require additional counseling if your dad meets certain thresholds though.

Unfortunately, the lender may not know if dad will hit the required thresholds until the lender proceeds and has ordered and received the appraisal.

Then the problem is that if they proceeded without the new counseling, the loan application would need to be cancelled and the lender would need to start all over with a new application and a new appraisal because HUD does not allow lenders to order any services on loans that require counseling until after that counseling has been completed.

Lenders typically will not allow borrowers or themselves to take that chance just to avoid counseling since the risk is greater than the reward, even if the state does not have laws to restrict it.

| Eric B. January 30th, 2020 |

| Michael Branson January 30th, 2020 |

Rather than looking up all state laws to post which states have more specific counseling requirements, I would rather answer you with the industry response.

HUD has not changed their counseling requirements which would allow a borrower to waive counseling if they had previously taken counseling and were refinancing that loan within 5 years and met certain requirements.

However, some states have as well as lenders, investors and industry agencies like the National Reverse Mortgage Lenders Association (NRMLA) which all seek to improve the security for borrowers have changed the counseling requirements. HUD sets the minimum that is required in all cases but also encourages lenders to always seek to protect the program and the borrowers.

So although some states still allow lenders to follow the HUD guidelines that have not changed, most lenders and investors (investors are those who buy the loans in the secondary market) follow the NRMLA industry standards set to protect senior homeowners from those who would engage in equity stripping through constant refinancing.

To this end, counseling is generally required by most lenders on every transaction at this time, whether the state requires it or not to be sure all borrowers are fully aware of the program changes.

Furthermore, on a refinance transaction, there are several "tests" that the borrower must meet in order to be eligible for the loan. You must be able to receive at least 5 times the cost of the loan in new benefits and at least 10% in additional principal limit to meet the eligibility restrictions that NRMLA imposes on lender members to maintain an ethical standard and not be engaging in refinance churning.

In addition, the loan must have been closed at least 18 months prior to the application for refinance. The changes became effective as a result of some originators zeal to push borrowers to refinance for relatively small rewards and soon after their past loans closed.

So the bottom line is that you really would be required to have counseling for a refinance again in all instances unless you were located in a state that did not require it and you were able to find a lender that did not adhere to the NRMLA code of conduct for ethical lenders. I am afraid I could not tell you who might do that in your state.

All Reverse Mortgage is a NRMLA member and as such, we do adhere to their professional, ethical standards.

| Mary Ziegenhagen May 13th, 2019 |